In the world of financial markets, swing trading has emerged as a popular strategy for active traders seeking to capitalise on short to medium-term price movements. Unlike day trading, which involves buying and selling assets within the same trading day, or position trading, which involves holding assets for an extended period, swing trading involves holding positions for several days to weeks. This article aims to provide a comprehensive guide to swing trading strategies, covering everything from the basics to advanced techniques for success.

Understanding Swing Trading

Swing trading differs from other trading styles in its time frame and objectives. While day traders focus on intraday price movements and position traders take a longer-term view, swing traders aim to profit from the “swings” or fluctuations within the market’s trend. This approach allows them to capitalise on short-term price momentum while avoiding the noise and volatility of shorter timeframes.

Key principles of swing trading include identifying trends, determining entry and exit points, and managing risk. Swing traders often use technical analysis techniques to examine price charts and identify potential trading opportunities. However, fundamental analysis can also be useful, particularly in identifying catalysts or news events that may impact the market. Explore the Saxo Bank group to get started.

Essential Tools and Resources

To succeed in swing trading, traders need access to a variety of tools and resources. These may include charting software, technical indicators, news feeds, and trading platforms. Reliable sources of information, such as books, websites, forums, and online communities, can also provide valuable insights and support.

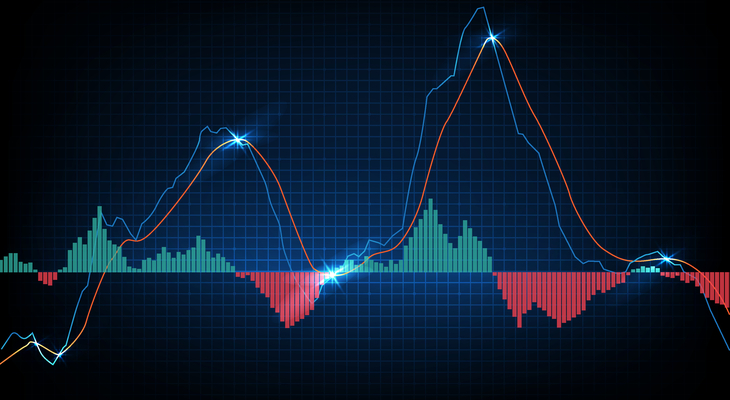

Technical analysis is a cornerstone of swing trading, as it helps traders identify trends, patterns, and potential entry and exit points. Popular technical indicators include moving averages, relative strength index (RSI), and moving average convergence divergence (MACD). Chart patterns, such as head and shoulders, double tops/bottoms, and triangles, can also provide valuable signals for swing traders.

Fundamental Analysis Considerations

While technical analysis is the primary tool for many swing traders, fundamental analysis can also play a role in their decision-making process. Fundamental analysis involves evaluating the underlying factors that may influence an asset’s price, such as economic indicators, earnings reports, and geopolitical events.

In swing trading, fundamental analysis can help traders identify catalysts or news events that may trigger price movements. By staying informed about key developments in the market, swing traders can better anticipate potential opportunities and risks.

Developing a Swing Trading Strategy

Successful swing trading requires a well-defined strategy that outlines clear goals, objectives, and criteria for entering and exiting trades. Traders must determine their risk tolerance, preferred trading time frame, and the types of assets they want to trade.

A typical swing trading strategy involves identifying trends, waiting for pullbacks or retracements, and entering trades in the direction of the trend. Traders may use technical indicators to confirm their entry and exit points and manage risk through position sizing and stop-loss orders.

Advanced Swing Trading Strategies

In addition to basic swing trading strategies, there are several advanced techniques that experienced traders may employ to enhance their returns. These include momentum trading strategies, which involve trading in the direction of strong price momentum, and reversal trading strategies, which aim to identify trend reversals before they occur.

Pullback trading strategies involve entering trades after a short-term retracement within a longer-term trend, while gap trading strategies capitalise on price gaps that occur between trading sessions. Each of these strategies has its own set of rules and techniques, and traders may choose to combine them or adapt them to suit their individual preferences and risk tolerance.

Risk Management and Psychology

Risk management is a critical aspect of swing trading, as it helps traders protect their capital and minimise losses. This may involve setting stop-loss orders to limit potential losses on individual trades, diversifying across multiple trades or asset classes, and avoiding over-leveraging.

In addition to risk management, psychology plays a crucial role in swing trading success. Traders must learn to manage their emotions, such as fear and greed, and maintain discipline and consistency in their trading approach. This may involve developing a trading plan, sticking to predetermined rules and criteria, and avoiding impulsive or emotional decision-making.

Backtesting and Optimization

Backtesting is a valuable tool for swing traders, as it allows them to evaluate the performance of their trading strategies using historical data. By analysing past trades and outcomes, traders can identify strengths and weaknesses in their strategies and make necessary adjustments or optimisations.

During the backtesting process, traders may test different variations of their strategy, such as varying entry and exit criteria or adjusting risk management parameters. Optimisation techniques, such as genetic algorithms or parameter optimisation, can help traders identify the most effective settings for their strategies and improve their overall performance.

Conclusion

Swing trading offers active traders the opportunity to profit from short to medium-term price movements within the market’s trend. By understanding the principles of swing trading, utilising the right tools and resources, and developing a strategic approach, traders can increase their chances of success in the dynamic world of a financial market. However, success in swing trading requires discipline, patience, and a willingness to continuously learn and adapt to changing market conditions.